montana sales tax rate change

We can also see the progressive nature of Montana state income tax rates from the lowest MT tax rate bracket of 1 to the highest MT tax rate bracket of 675. What is the sales tax rate in Miles City Montana.

The Montana sales tax rate is currently.

. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 0000. Look up 2022 sales tax rates for Cameron Montana and surrounding areas.

The December 2020 total local sales tax rate was also 0000. Base State Sales Tax Rate. The minimum combined 2022 sales tax rate for Billings Montana is.

This is the total of state county and city sales tax rates. June 1 2021. This is the total of state county and city sales tax rates.

Combined Sales Tax Range. The Martin City sales tax rate is NA. The County sales tax.

Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session. The County sales tax. The minimum combined 2022 sales tax rate for Shepherd Montana is.

The current total local sales tax rate in Joliet MT is 0000. The minimum combined 2022 sales tax rate for Roy Montana is. This reduction begins with the 2022 tax year.

Montanas sales tax rates for commonly exempted categories are listed. 2022 Montana Sales Tax Table. There is 0 additional.

This is the total of state county and city sales tax rates. The Montana sales tax rate is currently. The Montana sales tax rate is currently.

Montana charges no sales tax on purchases made in the state. Income Tax Rates Deductions and Exemptions. Tax rates are provided by Avalara and updated monthly.

Montana currently has seven. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

The Montana State Sales Tax is collected by the merchant on all qualifying sales made within Montana State. The state sales tax rate in Montana is 0000. The minimum combined 2022 sales tax rate for Bigfork Montana is.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Miles City Montana is. The Montana sales tax rate is currently.

Local Sales Tax Range. The state sales tax rate in Montana MT is currently 0. The Department of Justice provides several resources about Tobacco product sales in Montana including lists of.

The December 2020 total local sales tax rate was also 0000. Sales tax region name. There are no local taxes beyond the state rate.

Tax rates last updated in October 2022. The County sales tax rate is. The current total local sales tax rate in Conrad MT is 0000.

368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. Montana Sales Tax Ranges. The County sales tax.

The current total local sales tax rate in Big Sky MT is 0000. Look up 2022 sales tax rates for Cameron Montana.

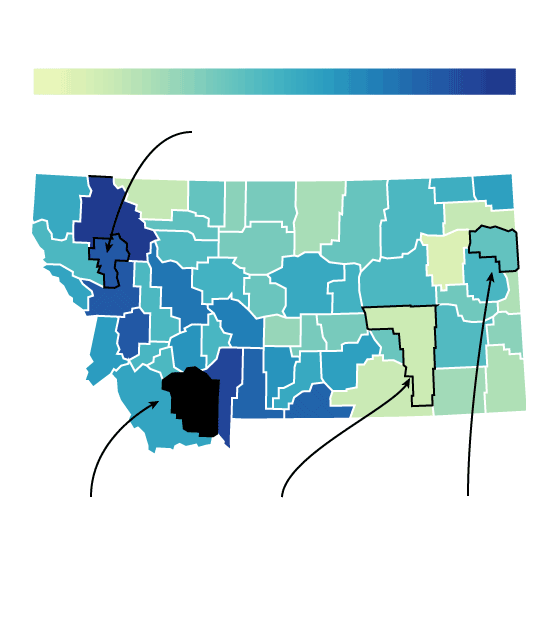

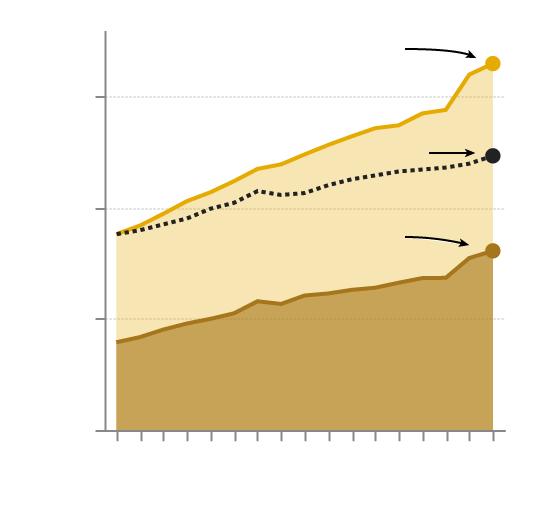

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

What S The Car Sales Tax In Each State Find The Best Car Price

How To Charge Sales Tax In The Us A Simple Guide For 2022

Montana Sales Tax Guide And Calculator 2022 Taxjar

Montana State Taxes Tax Types In Montana Income Property Corporate

Taxes Fees Montana Department Of Revenue

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

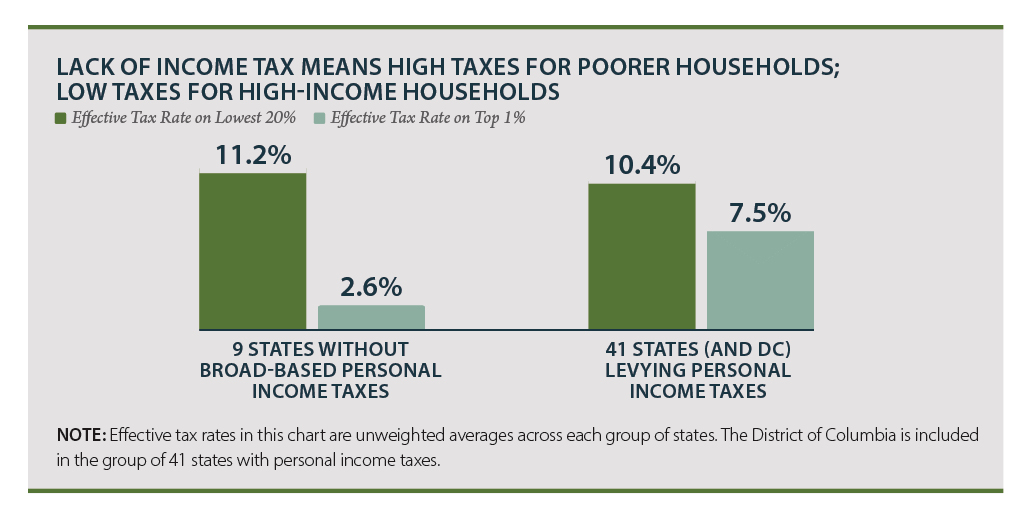

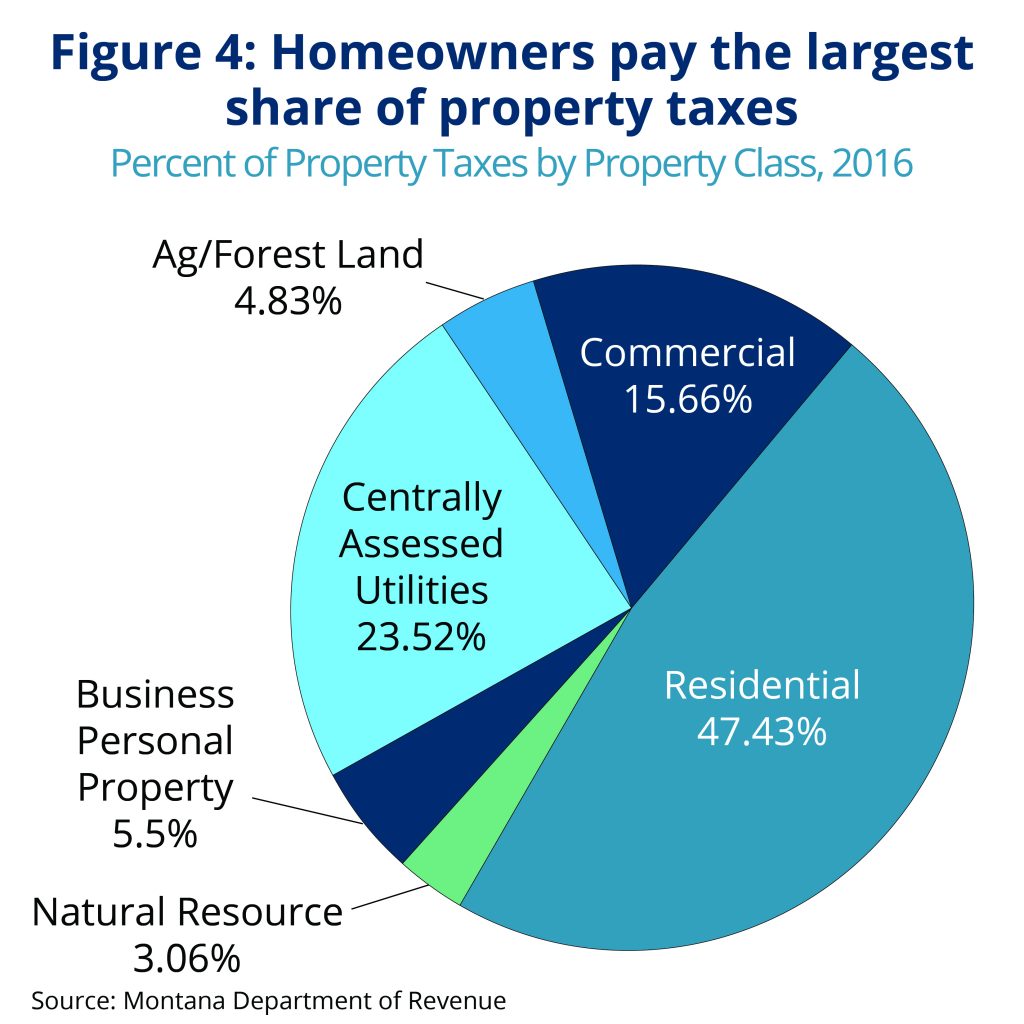

Policy Basics Property Taxes In Montana Montana Budget Policy Center

2021 State Corporate Tax Rates And Brackets Tax Foundation

Montana Vehicle Sales Tax Fees Find The Best Car Price

Sales Tax On Saas A Checklist State By State Guide For Startups

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Retirement Tax Friendliness Smartasset

Montana Vehicle Sales Tax Fees Find The Best Car Price

What Is Sales Tax A Complete Guide Taxjar